FAFSA Simplification

Simplifying the financial aid application process: the FAFSA Simplification Act is an initiative by the United States Department of Education to make applying for federal student aid easier for students.

- The new 2024-2025 FAFSA soft launched on December 31, 2023.

- FAFSA information will be shared with schools starting in mid March 2024.

- There will no longer be an EFC (Expected Family Contribution), the new formula will use the Student Aid Index (SAI).

When will the new FAFSA® be available?

The 2024-2025 FAFSA (used to apply for aid for the Fall 2024, Spring 2025, and Summer 2025 semesters) is available now at fafsa.gov.

When will I get my aid offer for the 2024-2025 academic year?

Our goal is to get aid information to students as quickly as possible. We appreciate your patience as we all navigate the new FAFSA!

The FAFSA is getting a facelift to make it easier for you in the future. However, this means there's a slight hold-up. This year, the information we need to make financial aid decisions will come to us later than usual.

The U.S. Department of Education is responsible for processing FAFSAs—the delay is beyond our control. Every college and university in the nation is experiencing this delay.

We know you are waiting to hear about financial aid offers, and we understand how important this is. We expect to start receiving FAFSAs in mid-March. We promise to get your financial aid details to you as soon as we can once we have all the information we need from the FAFSA.

We're adjusting our schedules and getting everything ready so that as soon as the FAFSA details come through, we're on it. Our team is also here to answer any questions and help you with other guidance you might need during this time.

If you haven't already submitted a 2024-2025 FAFSA, do so today at fafsa.gov to unlock the fullest range of financial aid options available to you. The FAFSA will help to maximize your chances of getting the best support package to make your education journey smoother.

Students and families will see a different measure of their ability to pay for college and experience a change in the methodology used to determine aid. The benefits of FAFSA simplification include:

- A more streamlined application process

- Expanded eligibility for federal student aid

- Expanded eligibility for the Federal Pell Grant

- Reduced barriers for certain student populations

- A better user experience for the FAFSA form

- Enhanced data sharing with IRS to simplify the applicant’s experience

In 2020, the FAFSA Simplification Act was enacted into law as part of the Consolidated Appropriations Act of 2021.

- Full implementation of major provisions will occur during the 2024–2025 award year (starting Fall 2024).

- The 2024–2025 FAFSA will be available in December 2023. The exact date has not yet been released by the Department of Education.

- Methodology will be introduced to calculate and determine applicant eligibility with a new need-analysis formula.

- Resources for completing the FAFSA form will be expanded to the 11 most common languages spoken in the United States.

- The number of questions will be reduced and the application will maximize the use of previously collected data.

- Students will be able to list up to 20 schools on their FAFSA via the online application.

- The Student Aid Index (SAI) will replace the Expected Family Contribution (EFC).

- The Cost of Attendance (COA) will be the starting point for calculating the SAI. COA includes direct costs (charges for which the university bills you directly) and estimated indirect costs (living expenses) to fund educational expenses for a year.

- Foster, homeless, and unaccompanied youth—as well as applicants who cannot provide parental information—will be able to complete the form with a provisional independent student determination and receive a calculated SAI.

- Anyone asked to provide information on the aid application—student, spouse, student’s parent(s) and/or stepparents(s)—is called a “contributor” to the application.

- Students, spouses, parents, and stepparents (contributors) will now need to provide their consent to provide their Federal Tax Information (FTI) in the new Consent to Retrieve and Disclose Federal Tax Information section of the FAFSA for federal student aid eligibility.

- A direct data share with the IRS will replace what is currently known as the IRS Data Retrieval Tool (DRT).

- If any contributor to the FAFSA form does not provide consent, submission of the form will still be allowed. However, a Student Aid Index (SAI) will not be calculated.

- The Custodial Parent on your FAFSA will be the parent(s) who provided you with more financial support, instead of the parent(s) with whom you lived more during the past 12 months.

- There will be two-step verification and all FAFSA contributors must have an FSA ID to log into the online form. There will be a new process to get an FSA ID for parents and spouses without a Social Security number.

- Applicants will be asked to report their sex, race, and ethnicity on the FAFSA itself, but students will be offered a choice of “Prefer Not to Answer.” Schools and state agencies won’t see responses to these questions on the FAFSA.

Students and families will see a different measure of their ability to pay for college, and they will experience a change in the methodology used to determine aid.

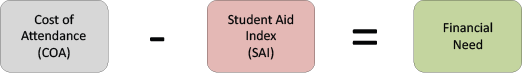

- The formula for calculating the Student Aid Index (SAI) is: COA – SAI = financial need.

- The new need-analysis formula:

- removes the number of family members in college from the calculation,

- allows a minimum SAI of -$1,500,

- implements separate eligibility determination criteria for Federal Pell Grants based on federal poverty levels and family size.

- Child support received will be included in assets and not as untaxed income.

- Families who own a small business/farm that also serves as primary residence will now have assets of that business/farm considered in their need-analysis calculation.

Additional Information from the U.S. Department of Education on FAFSA Simplification Act Changes for Implementation in 2024-25.

On Dec. 27, 2020, Congress passed the Consolidated Appropriations Act, which included provisions that amended the Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act and included the FAFSA Simplification Act—a sweeping redesign of the processes and systems used to award federal student aid.

This process is the first major redesign of the Free Application for Federal Student Aid (FAFSA) process in over 40 years. It represents a significant overhaul of federal student aid, including the FAFSA form, need analysis, storage of federal student aid application data, and many policies and procedures for schools that participate in the Title IV programs.

FSCJ's Office of Financial Aid and Scholarships will continue to update this webpage as we receive more information from the U.S. Department of Education.